LPT Realty vs. Berkshire Hathaway HomeServices: Flexibility, Growth, and Income Compared

LPT Realty vs. Berkshire Hathaway HomeServices: Flexibility, Growth, and Income Compared

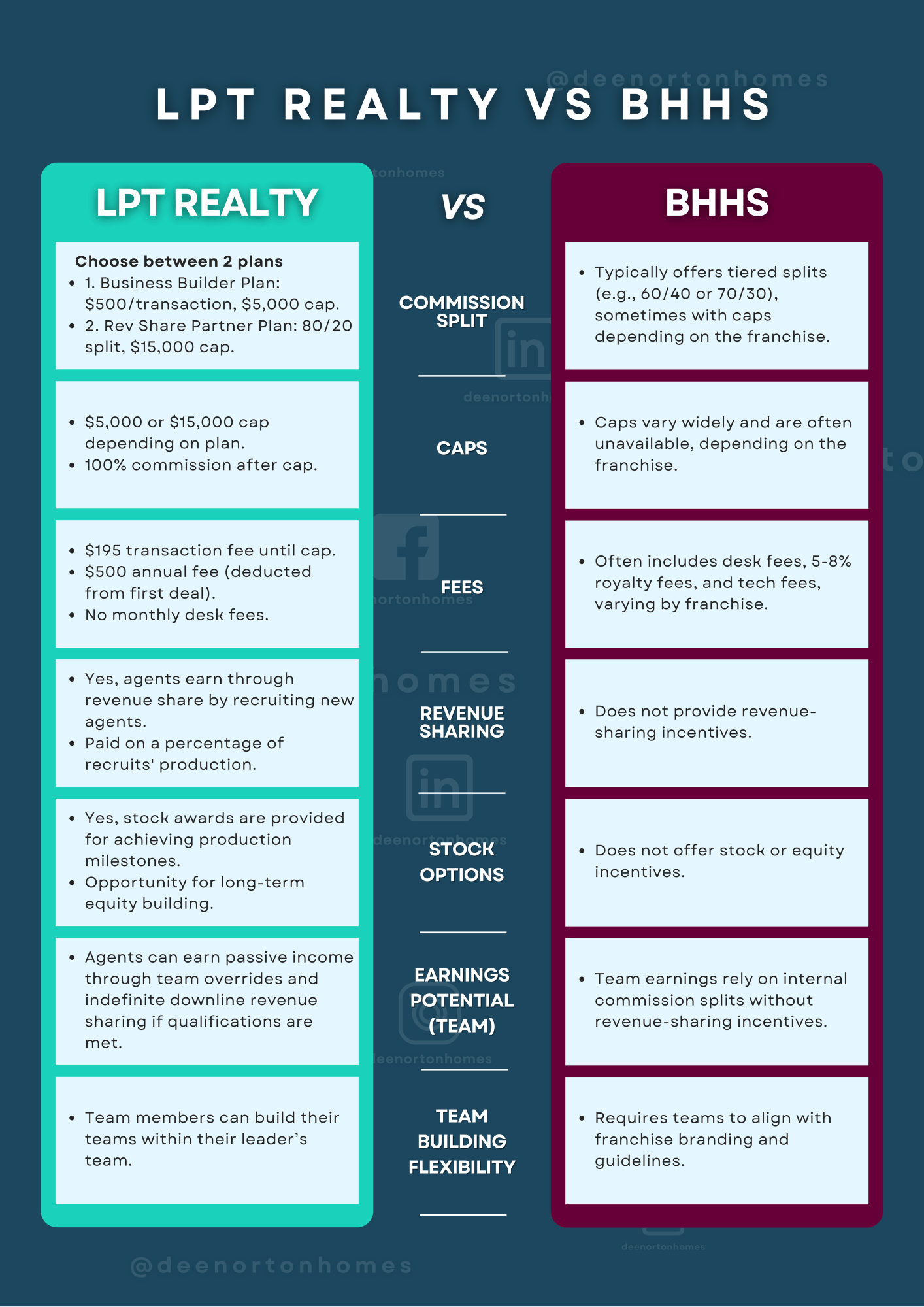

Commission & Caps: How Much Do You Keep?

🔹 LPT Realty – Two plans:

• Business Builder: $500/transaction, $5K cap.

• Rev Share Partner: 80/20 split, $15K cap.

• 100% commission after cap.

🔹 BHHS – Typically tiered splits (e.g., 60/40 or 70/30), caps vary by franchise.

👉 Want to cap and keep 100%? LPT Realty is the better deal.

Fees: What’s Coming Out of Your Pocket?

🔹 LPT Realty – $195 per transaction (until cap), $500 annual fee, no monthly desk fees.

🔹 BHHS – Desk fees, 5-8% royalty fees, and tech fees (varies by franchise).

👉 For lower, predictable costs, LPT Realty wins.

Revenue & Stock: Building Long-Term Wealth

🔹 LPT Realty – Revenue sharing, stock awards, and team overrides.

🔹 BHHS – No revenue sharing, no stock options.

👉 Want passive income and equity? LPT Realty is the way to go.

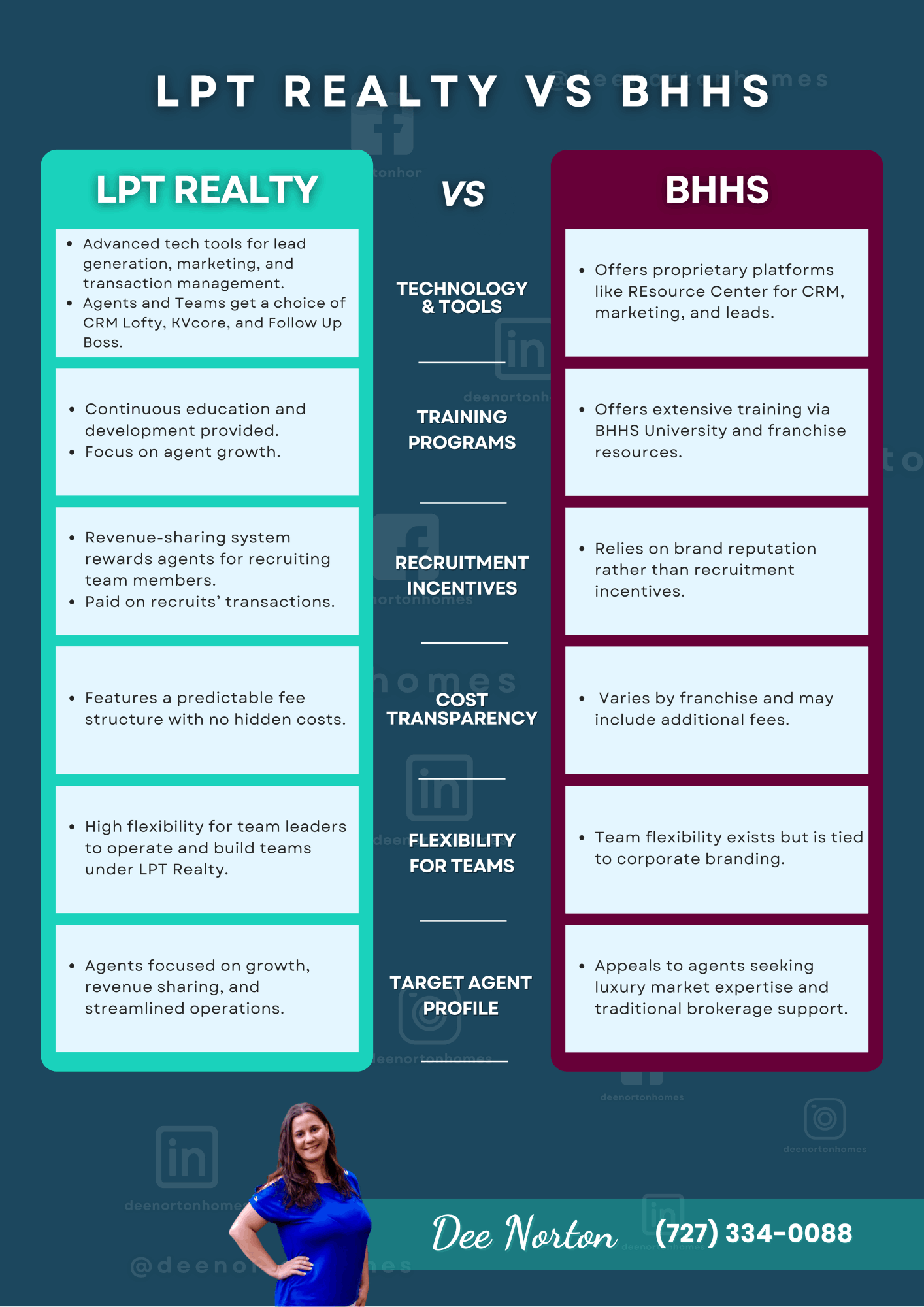

Tech & Training: Tools to Help You Grow

🔹 LPT Realty – Lofty, KVcore, Follow Up Boss + continuous education.

🔹 BHHS – Proprietary CRM & BHHS University training.

👉 Prefer customizable tools? LPT Realty. Want structured training? BHHS.

Team Building: Flexibility Matters

🔹 LPT Realty – Build teams with full branding flexibility.

🔹 BHHS – Team branding must align with franchise guidelines.

👉 Want control over your team? LPT Realty is more flexible.

Who’s the Best Fit?

✅ LPT Realty – Ideal for agents who want:

✔️ More commission & passive income

✔️ Lower, predictable fees

✔️ Branding & team-building freedom

✅ BHHS – Better for agents who:

✔️ Prefer a traditional brokerage structure

✔️ Value franchise brand recognition

✔️ Want structured training

Final Take

If financial freedom, multiple income streams, and flexibility matter, LPT Realty is a strong choice. If you prefer franchise branding and structured support, BHHS might be better.

Still deciding? Let’s chat and find the best fit for your career!

Categories

Recent Posts